Should You Renovate or Relocate?

Moving can be a hassle—or too costly in this competitive market. When does it make sense to stay put instead of move on?

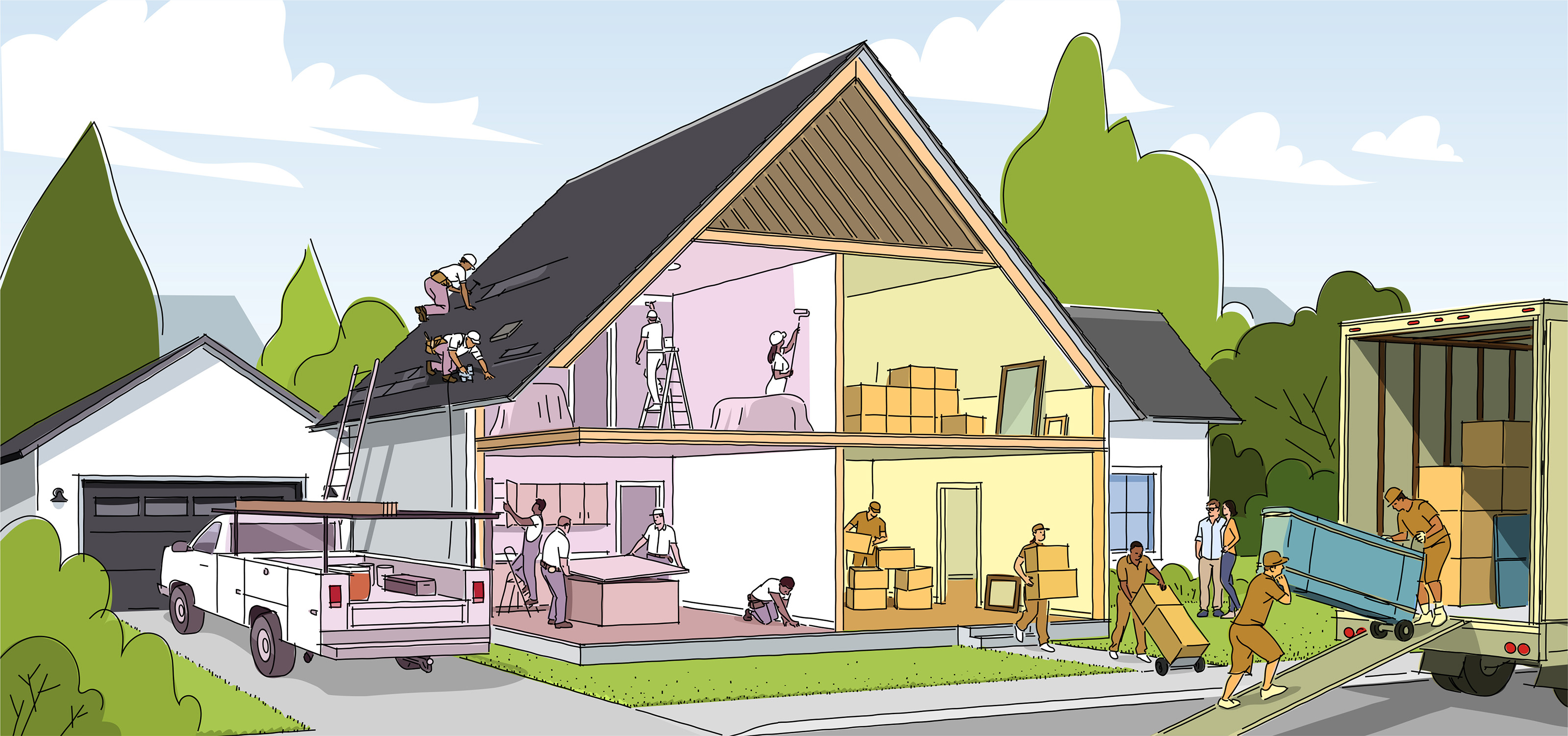

It’s a real estate question as old as time: Is it better to renovate or buy something new (or move-in ready)? For some, that might mean deciding between updating a home they already own versus moving on to a new property. For others, the renovation question looms large over their home search as they grapple with whether to buy a fixer-upper or new construction.

Factors like fluctuating construction costs, an uptick in new home builds and varying loan interest rates make this decision all the more difficult. “In the current competitive market conditions, the choice between renovating and finding a new property largely depends on the individual,” says Gino Blefari, chairman and CEO of Berkshire Hathaway HomeServices. “It’s crucial you weigh your real estate wants and needs with the actual costs of renovating versus purchasing a different home.”

We asked readers of The Wall Street Journal who are considering renovating or relocating to share their biggest concerns about the decision-making process. Below is a sampling of popular questions, along with answers and insights from Berkshire Hathaway HomeServices’ network leaders.

I’m unsure about whether to renovate our current home or purchase a new build. What should I consider to help make a decision?

Stephen C. Roney, CEO and Owner, Berkshire Hathaway HomeServices Utah Properties:

Many homeowners bought their homes when the interest rates were lower—let’s say 3%—so naturally they are wary of losing that rate. If I had a client in that situation, who also really wanted to stay in their current neighborhood but needed to change their living situation, renovating instead of moving would likely be their best option. Whatever the cost is of updating your property—let’s say it’s $100,000—you’ll only be paying a higher interest rate on that incremental cost. So if you have a $500,000 existing mortgage and you take out a secondary loan with a 7% rate, you’re going to be paying that higher rate on a much smaller segment of your overall mortgage than if you had to take out a new mortgage to cover the cost of a new home purchase.

If you’re more open about moving to a new neighborhood, I can tell you that developers across the U.S., but particularly here in Utah, have been building aggressively over the past few years, and they are not stopping. So there’s a lot of inventory that is opening up for homebuyers to choose from. Developers can also sweeten the deal by using mortgage buy-downs to offset the costs of the higher interest rates that we’re currently experiencing. That can be a huge selling point for potential buyers and make a new build the better financial decision for them.

What about buying a fixer-upper to renovate? Is that more fiscally responsible than buying land to build on?

Martha Mosier, President, Berkshire Hathaway HomeServices California Properties:

Whether you should buy a home that requires renovations or buy land to build really boils down to several key factors, including cost, time and personal preferences. A lot hinges on financing. Renovating a home typically proves to be a financially more prudent choice if you’re going to be seeking financing. When financing a home that you plan on renovating, the upfront costs are often much lower versus buying land and constructing a new home. For instance, home mortgage rates right now are between 6% and 7%, and that’s a lot more manageable than a 10% to 20% interest rate that you might be looking at for land and construction loans. And the cash down payments required on land and construction loans are often much higher.

You also have to think about additional costs beyond the financing considerations. Renovating a home offers several practical advantages. Since the structure already exists, navigating and planning the permitting process with local authorities tends to be a little easier and less scrutinized compared to building from scratch. The utilities you’ll need in your home are already typically hooked up and working in an existing fixer-upper, which eliminates the need (and costs) to install electric, gas, sewer and water systems from scratch.

If you’re building on raw land, there are so many different levels of inspection and approval processes that you need to go through that you don’t necessarily have to go through with a renovation, depending on the scope of that renovation. All those inspections and permits cost both time and money, so it’s definitely something worth considering if you’re trying to decide between buying a fixer-upper and building on raw land.

Can you share any recommendations on which home renovations I should consider if I plan to sell within two to three years?

Stacy Mathews, CEO and Owner, Berkshire Hathaway HomeServices Premier Properties:

The curb appeal of the property is the first thing that a buyer sees when they pull up to the home. So if that’s not updated, definitely consider refreshing the landscaping—it’s just crucial for that first impression. When you get inside the property, I find the kitchen is one of the most sought after for renovations, followed by the bathrooms. If you have over a year before you plan on selling, put time and money into those improvements.

Another renovation project with a high return on investment is updating the flooring. If you have a house with hardwoods, I’d recommend having them refinished. Fresh carpet in high-traffic rooms goes a long way when it comes to a buyer’s impression. Time those a bit closer to your move, for obvious reasons!

After you make those cosmetic improvements, take a look “under the hood” of your home. Have things like your electrical, plumbing and HVAC checked out. I can’t tell you how many deals have been soured by a bad inspection, post-offer. Being proactive about making any fixes before you list your property can make the selling process that much more seamless and rewarding.